snohomish property tax due date

Snohomish County Property Tax Due Dates. Snohomish county property tax due dates.

About Our District 2022 Snohomish School District Proposed Replacement Levies

If your payment due date falls on a weekend or a federal holiday your payment is due the next business day.

. Taxes are due and payable in full upon receipt OR you may choose the option of paying in two halves. When summed up the property tax burden all. If paying after the listed due date additional amounts will be owed and billed.

Snohomish county property tax due dates. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. Snohomish County Government 3000 Rockefeller Avenue Everett WA 98201.

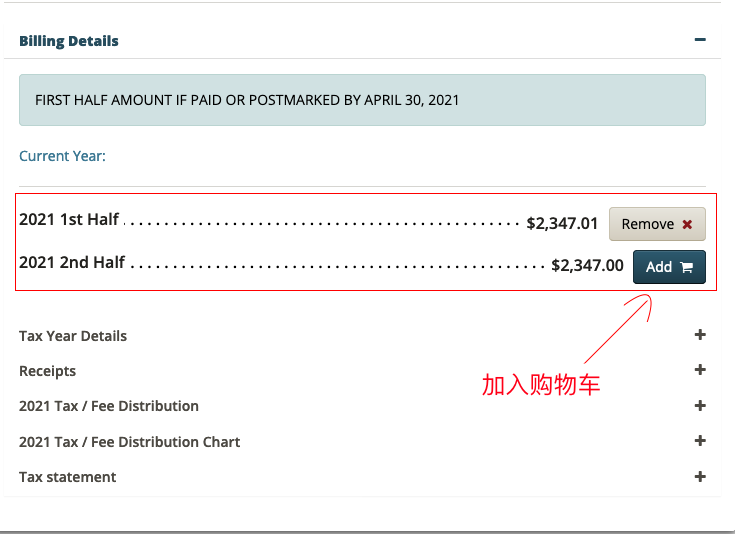

Real estate taxes for the first half or full payment are due April 30th and taxes for the second half are due October 31st. Property taxes levied for the property tax year are payable in two installments. Deadline will now be June 1 2020.

Snohomish County collects on average 089 of a propertys. The first installment is due September 1 of the property tax year. First half taxes are due and payable without penalty on or before January 10 2022.

You can pay your taxes online from a smartphone tablet or personal computer. Using this service you can view and pay them online. In fiscal years ending in 2009 local governments and school districts outside of New York.

School districts are the largest users of the property tax. For most homeowners that pay their taxes with their mortgage payment however there wont be any relief. King Pierce and Snohomish County have extended the payment due.

Lincoln powerluber grease gun. For the price of little more than a postage stamp 175 an e-check payment generates an immediate. Extra Time for Quarterly Payers.

EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County. Adam hollander hungry wolves. Brownberry buttermilk bread.

Please note that 1st Half Taxes are Due April 30th. The second installment is due March 1. First half taxes are due April 30.

Where the property tax goes. Second half taxes are due October 31. Please refer to the back of your tax statement to determine eligibility or you may contact the.

The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. Pierce County Assessor-Treasurer Mike Lonergan announced Monday that due date for first-half property tax payments would be extended to June 1 2020.

Snohomish County Wa Assessor Map Lookup

Job Opportunities Sorted By Posting Date Descending Help Starts Here

914 13th St Snohomish Wa 98290 Mls 1875992 Redfin

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

About Our District 2022 Snohomish School District Proposed Replacement Levies

Graduated Real Estate Tax Reet For Snohomish County

Several Wash Counties Extending Property Tax Deadlines Amid Pandemic Komo

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed

Snohomish County Washington Genealogy Familysearch

About Our District 2022 Snohomish School District Proposed Replacement Levies

News Flash Snohomish County Wa Civicengage

The Property Tax Annual Cycle In Washington State Myticor

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News

About Our District 2022 Snohomish School District Proposed Replacement Levies

The Property Tax Annual Cycle Myticor

Snohomish Weighs Tax Breaks For Affordable Homes Though Results Vary Heraldnet Com

Treasurer Snohomish County Wa Official Website

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting